Hey there! Have you ever wondered about the importance of liquidity accounting in accounting practices? Liquidity accounting is crucial in determining a company’s financial health by evaluating its ability to meet short-term obligations. By keeping track of cash flow and liquidity ratios, businesses can make informed decisions that impact their overall financial stability. Let’s delve into why liquidity accounting is a key aspect of accounting practices and how it helps organizations thrive in today’s dynamic business environment.

Importance of Liquidity in Accounting

Liquidity in accounting refers to a company’s ability to meet its short-term financial obligations. It is crucial for businesses to maintain adequate levels of liquidity to ensure they can pay their bills, employees, and other expenses on time. Without enough liquidity, a business may struggle to stay afloat and could face bankruptcy.

One of the main reasons why liquidity is so important in accounting is because it provides a measure of a company’s financial health. By analyzing a company’s liquidity ratios, such as the current ratio and quick ratio, investors and lenders can get a better understanding of its ability to meet its short-term obligations. This information is essential for making informed decisions about whether to invest in or lend money to a particular company.

Additionally, liquidity also plays a critical role in ensuring the smooth operation of a business. When a company has enough cash on hand to cover its expenses, it can avoid disruptions in its day-to-day operations. For example, having sufficient liquidity can prevent delays in paying suppliers, which could lead to shortages of essential materials or services.

Furthermore, liquidity accounting is crucial for assessing a company’s risk exposure. A business with low levels of liquidity is more vulnerable to financial shocks, such as unexpected expenses or a downturn in the market. By monitoring liquidity levels and implementing strategies to improve them, companies can better protect themselves from potential risks and uncertainties.

In conclusion, liquidity accounting is essential for the financial stability and success of a business. By maintaining adequate levels of liquidity, companies can ensure they have the financial resources to meet their short-term obligations, operate smoothly, and manage risks effectively. It is therefore important for businesses to regularly monitor their liquidity ratios and take steps to improve them when necessary.

Liquidity Ratios for Assessing Financial Health

When it comes to assessing the financial health of a company, liquidity ratios play a crucial role in providing valuable insights into the organization’s ability to meet its short-term obligations. These ratios are used by investors, creditors, and financial analysts to evaluate how easily a company can convert its assets into cash to cover its current liabilities. In this section, we will delve into some of the key liquidity ratios commonly used in financial analysis.

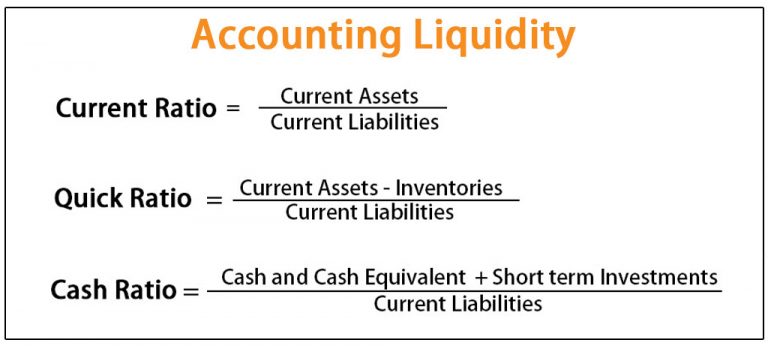

One of the most widely used liquidity ratios is the current ratio, which is calculated by dividing current assets by current liabilities. The current ratio provides a quick snapshot of a company’s ability to meet its short-term obligations with its current assets. A ratio of 1 or higher is generally considered healthy, as it indicates that a company has enough current assets to cover its current liabilities. However, a current ratio that is too high may signal that a company is not efficiently using its assets.

Another important liquidity ratio is the quick ratio, also known as the acid-test ratio. The quick ratio is similar to the current ratio but excludes inventory from current assets, as inventory may not be as easily convertible into cash. By focusing on the most liquid assets, such as cash and accounts receivable, the quick ratio provides a more conservative measure of a company’s ability to cover its short-term obligations. A quick ratio of 1 or higher is generally desirable, as it indicates that a company can meet its current liabilities without relying on inventory sales.

The cash ratio is another liquidity ratio worth mentioning, as it provides an even stricter measure of a company’s ability to cover its short-term obligations. The cash ratio is calculated by dividing cash and cash equivalents by current liabilities. This ratio focuses solely on a company’s cash reserves, excluding other current assets, to assess its liquidity position. A cash ratio of 0.2 or higher is typically considered satisfactory, as it indicates that a company has enough cash on hand to cover its current liabilities.

Besides these ratios, there are other liquidity metrics that can provide valuable insights into a company’s financial health. For example, the operating cash flow ratio measures a company’s ability to generate cash from its core operations to cover its short-term obligations. A higher operating cash flow ratio indicates that a company is able to generate sufficient cash flow to meet its immediate financial needs.

In conclusion, liquidity ratios are essential tools for assessing a company’s financial health and its ability to meet short-term obligations. By analyzing these ratios, investors, creditors, and financial analysts can gain valuable insights into a company’s liquidity position and make informed decisions about its financial viability. It is important to interpret these ratios in conjunction with other financial metrics to get a comprehensive understanding of a company’s overall financial health.

Managing Liquidity Risk in Accounting

When it comes to managing liquidity risk in accounting, companies need to have a thorough understanding of their current financial situation and be able to anticipate potential cash flow issues. One of the key strategies in managing liquidity risk is to maintain a healthy cash reserve to cover any unexpected expenses or fluctuations in revenue.

Another important aspect of managing liquidity risk is to closely monitor and manage accounts receivable and accounts payable. By ensuring that invoices are sent out promptly and payments are collected on time, companies can improve their cash flow and reduce the risk of running into liquidity problems.

Furthermore, companies can also utilize various financial instruments such as lines of credit, overdraft facilities, and short-term loans to manage liquidity risk. These instruments can provide companies with the necessary funding to cover short-term cash flow shortages and help them navigate through uncertain times.

In addition to maintaining a healthy cash reserve and managing accounts receivable and accounts payable, companies can also optimize their working capital management to improve liquidity. This includes managing inventory levels, reducing outstanding liabilities, and optimizing the use of cash resources to enhance overall liquidity position.

Overall, managing liquidity risk in accounting requires a proactive approach and careful financial planning. By implementing sound liquidity management practices and utilizing the right financial instruments, companies can better safeguard against cash flow challenges and maintain financial stability.

Cash Flow Statement Analysis for Liquidity Accounting

When it comes to liquidity accounting, the cash flow statement plays a crucial role in providing valuable insights into the financial health of a company. This statement helps investors, creditors, and other stakeholders understand how a company manages its cash flow and assess its ability to meet short-term financial obligations.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. Each section provides valuable information that can be used to analyze a company’s liquidity position.

1. Operating Activities: This section of the cash flow statement shows the cash generated or used by a company’s core business operations. By analyzing the cash flow from operating activities, investors can assess the company’s ability to generate cash from its primary business activities. A positive cash flow from operating activities indicates that the company is generating enough cash to cover its day-to-day expenses and meet its short-term obligations.

2. Investing Activities: The investing activities section of the cash flow statement shows the cash flow generated or used by a company’s investments in assets such as property, plant, and equipment. By analyzing the cash flow from investing activities, investors can understand how the company is investing its cash and assess its ability to maintain and grow its operations in the long run. A negative cash flow from investing activities may indicate that the company is investing heavily in its growth and expansion.

3. Financing Activities: The financing activities section of the cash flow statement shows the cash flow generated or used by a company’s financing activities, such as issuing or repurchasing stocks and bonds, paying dividends, or borrowing money. By analyzing the cash flow from financing activities, investors can assess the company’s ability to raise capital and manage its debt levels. A positive cash flow from financing activities may indicate that the company is able to attract investors and creditors to fund its operations.

4. Cash Flow Ratios: In addition to analyzing the individual sections of the cash flow statement, investors can also use cash flow ratios to assess a company’s liquidity position. Some common cash flow ratios include the operating cash flow ratio, the cash flow coverage ratio, and the free cash flow ratio. These ratios help investors understand how efficiently a company is managing its cash flow and whether it has enough liquidity to meet its short-term obligations.

Overall, the cash flow statement is a valuable tool for liquidity accounting, providing investors with important insights into a company’s financial health and ability to manage its cash flow. By analyzing the cash flow statement and using cash flow ratios, investors can make informed decisions about investing in a company and assess its ability to meet its short-term financial obligations.

Strategies for Improving Liquidity in Financial Statements

Ensuring that a company has enough liquidity is crucial for its financial health and stability. Liquidity refers to the ability of a company to meet its short-term obligations with its current assets. Companies with strong liquidity positions are better equipped to handle unexpected expenses, take advantage of new opportunities, and weather financial downturns. Here are some strategies that organizations can implement to improve liquidity in their financial statements:

1. Manage Accounts Receivable Efficiently:

One of the most common strategies for improving liquidity is to manage accounts receivable efficiently. Companies should strive to collect payments from customers in a timely manner to ensure a steady flow of cash into the business. This can be achieved by setting clear payment terms, following up on overdue invoices, and offering incentives for early payment.

2. Monitor Inventory Levels:

Another important aspect of liquidity management is monitoring inventory levels. Excess inventory ties up valuable capital that could be used for other purposes. Companies should regularly review their inventory levels and implement strategies to prevent overstocking, such as implementing just-in-time inventory systems or offering discounts on slow-moving items.

3. Negotiate Favorable Payment Terms with Suppliers:

One effective way to improve liquidity is to negotiate favorable payment terms with suppliers. By extending payment terms or negotiating discounts for early payment, companies can improve their cash flow and preserve liquidity. Building strong relationships with suppliers and communicating openly about payment terms can lead to more favorable agreements.

4. Reduce Non-Essential Expenses:

Reducing non-essential expenses is another strategy that can help improve liquidity. Companies should regularly review their expenses and identify areas where costs can be cut without compromising the quality of products or services. This may involve renegotiating contracts with service providers, eliminating unnecessary overhead, or finding more cost-effective ways to operate the business.

5. Explore Financing Options:

When faced with liquidity challenges, companies can explore various financing options to improve their cash position. This may include obtaining a line of credit from a financial institution, securing a short-term loan, or issuing bonds or commercial paper. By leveraging external financing sources, companies can maintain liquidity without sacrificing long-term financial stability.

Overall, improving liquidity in financial statements requires a proactive approach to managing cash flow, assets, and liabilities. By implementing these strategies, companies can enhance their financial flexibility, increase their ability to respond to changing market conditions, and position themselves for long-term success.